What are Medicare Supplements?

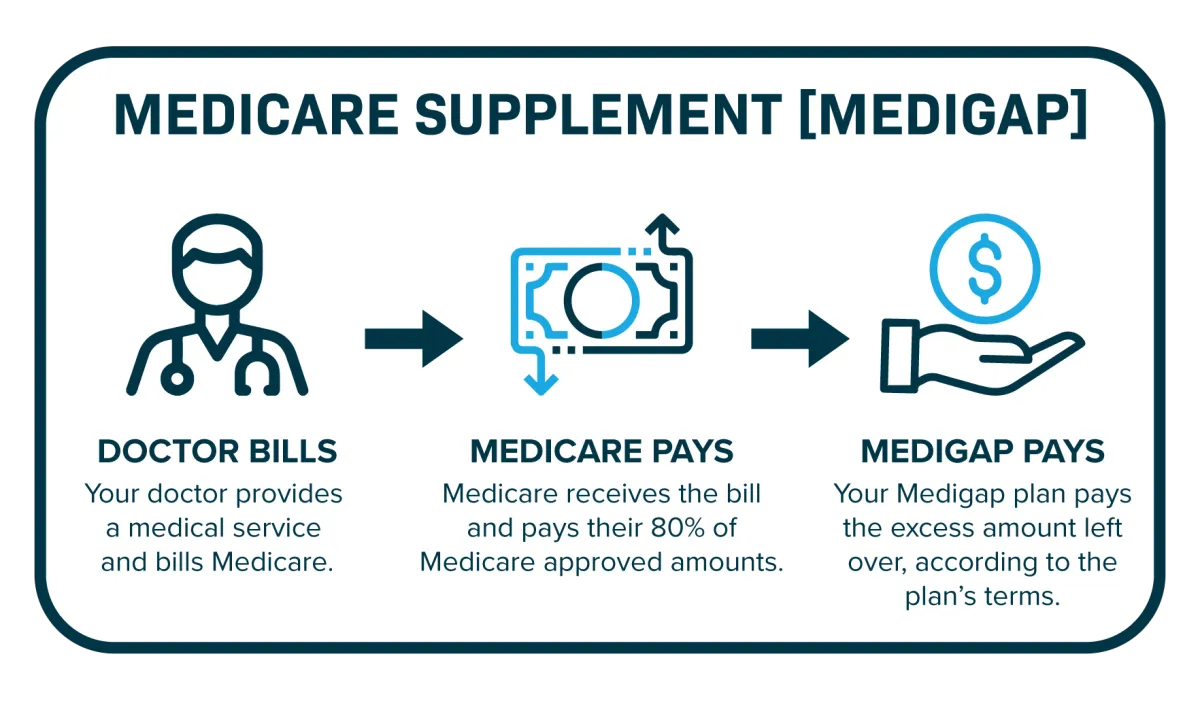

Medicare Supplement plans, also known as Medigap, are policies that help pay for the excess charges left over by Medicare. These costs are things like your deductibles and coinsurance.

What is Medicare Supplement Insurance?

Medicare Supplement plans, or Medigap, are insurance policies sold by private insurance companies that are licensed to sell Medicare plans. They help you pay for out-of-pocket costs for services covered under Medicare Part A and Part B. These costs include deductibles, coinsurance, copayments, hospital costs after Medicare pays its share, skilled nursing facility costs, and more. Some Medicare Supplement insurance plans even include coverage for medical services while traveling outside the United States.

What are the Different Plans?

Different Medicare Supplement plans are labeled with a different letter between A through N.

Medicare Supplements feature different benefits. However, each plan must have the same standardized coverage no matter which insurance company you purchase the plan from.

Some Medicare beneficiaries want a plan that covers everything so they don’t have to worry about out-of-pocket expenses. Others simply want some of their deductibles and copays paid for but are mostly worried about low premiums. Ultimately, the choice is up to you.

Which Medicare Supplements Have the Highest Coverage?

Medicare Supplemental Plan F has the highest level of coverage. It pays for all of your cost-sharing on covered services so you have no out-of-pocket expenses.

Medicare Supplemental Plan G is the second-best in terms of coverage. The only thing not covered is that you still pay the Part B deductible once per year. This keeps your Medigap premium lower and, in turn, may save some beneficiaries some money in the long run.

Five Things to Know About Medicare Supplement Plans

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

- You pay the private insurance company a monthly premium for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare.

- A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

- It's illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you're switching back to Original Medicare.

Services We Offer

Medicare Advantage

Medicare Advantage Plans offer coverage identical to Original Medicare with added benefits.

Medicare Supplement

Medicare Supplement Plans work with Original Medicare to lower out-of-pocket costs.

Annuities

A range of annuity options makes annuities a viable and appealing investment strategy for many retirement planners.

Health Insurance

Individuals and families can enroll in an ACA plan rather than an employer-sponsored or private plan.

"Fromme Insurance Services creates a better everyday life built on Trust, Compassion, and ensuring Security for you or your loved one, by offering affordable insurance solutions "

- Stephen Fromme

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options. Health Insurance sold on

frommeinsuranceservices.com is processed through the licensed entity: Garden State Medicare Solutions.